Kevin Graham wrote:Please be more specific. Which entitlement programs would you like to see cut, and by how much? And how on earth does that in any way boost the economy?

The US Government obligations for Social Security, Medicare and Medicaid need to be drastically rethought. It's not just a matter of "cutting" them; the nature and depth of the government's involvement needs to be changed.

I don't believe the government can "boost" the economy, so it shouldn't try.

Why don't you check the history books for your answer. Our economy prospered for more than fifty years after WWII because it did precisely the things you're warning us about now. Go figure.

The prosperity following WWII wasn't because of the government's involvement. The federal government did a lot of great things in that time period, but to give it credit for the prosperity of the country over the course of decades seems a little much.

And that prosperity certainly wasn't because the government was hiring people or borrowing, printing or redistributing money.

It proves he believed it did when he asked for it, especially when he stipulated in his letter that it was desperately needed for job growth.

I agreed that Ryan was a hypocrite when he asked for it, but that is the demand we place on representatives. When the government offers to redistribute money, even the best of us can become hypocrites.

Your repeating disproved myth. Again, virtually all studies have already proved the stimulus worked.

You say "worked" as if it were something in the past. All it did was kick the can down the road. We still haven't had a recovery, we're still screwed, and we're still pumping more and more money down that bottomless hole trying to hold off judgement day. The economy is still on life support, with a weak pulse, and everyone's dancing around like we're fully recovered.

Again, this is Glenn Beck nonsense. Inflation isn't happening, let alone "hyperinflation" as you folks have been predicting.

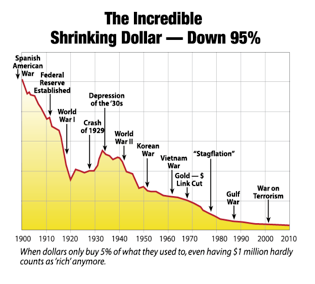

So, do you feel like your dollars are increasing in value, staying the same, or decreasing in value? The value of the dollar is decreasing by any standard. This will happen at an accelerating rate if the current monetary policies are continued. This will be bad for people who save money, and great for people who owe money. If you can show otherwise, there's a nobel prize with your name on it waiting for you.

Also, you should totally write up your ideas and send them to Greece, Spain, Italy and Ireland, since they've got the same problem we do, only they're further down the road and they can't print money to try and delay the inevitable.

But it has worked, and is working still. Take some time off from reading the National Review, and then spend a little time out in the real world.

I've never read the National Review or listened to Glen Beck. Sorry.