Published on Sunday, May 14, 2006

A Tale of Two Theories: Supply Side and Demand Side Economicsby Robert Freeman

It was the best of times. It was the worst of times. It was the era of low taxes. It was the age of high deficits. Prices were up. Wages were down. Oil and gold soared. Housing and big cars cratered. Foreign powers threatened. Foreign currencies beckoned. Some saw a new Jerusalem in the nation's future. Others saw only the glaucoma of gluttonous greed. It was the summer of economic hope. It was the winter of economic despair.

In short, the early eighties were an economic time not unlike our own, a time that scared the Dickens out of most sober observers.

The common thread that unites the two times is Supply Side Economics. In the eighties it was new and promising. In the aughts it is recycled and damaging. In both eras, it stood against Demand Side Economics in its prescription for how to manage the economy. But it is in their outcomes that the two theories present such stark and measurable differences.

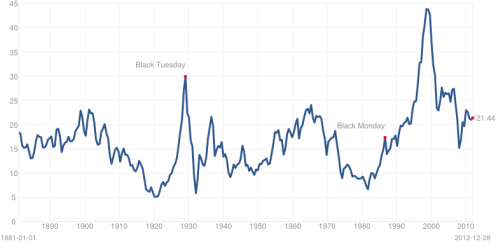

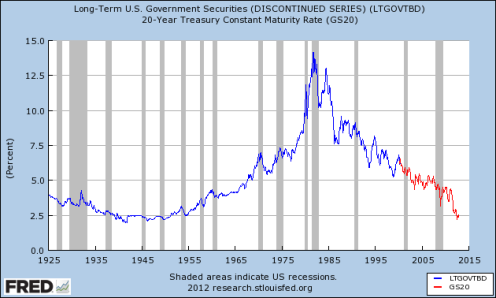

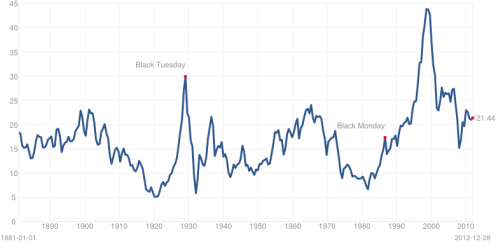

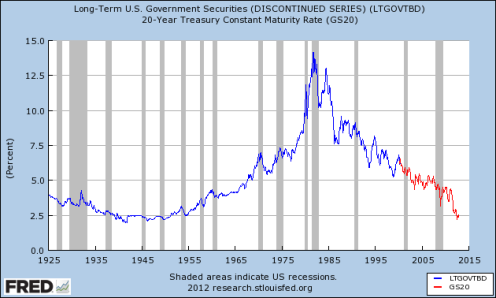

In the late seventies, the U.S. economy was falling to pieces. Johnson's Great Society programs and the Vietnam War had produced enormous inflationary pressures. But these were only the beginning. In 1973, Arab oil sheikdoms tripled the price of oil and in 1978, they tripled it again. Inflation soared, interest rates skyrocketed, and the economy tanked.

Higher prices cut into corporate profits, forcing employers to cut back production. The higher prices also reduced the purchasing power of workers, causing a slowdown in the economy. It was the worst of both worlds: a stagnant economy with rampant inflation. Economists called it "stagflation." They were at a loss for a cure.

Traditionally, to fight inflation, governments raise interest rates and cut spending, tampening down demand. To fight unemployment, they do the opposite: cut interest rates and raise spending, increasing demand. But now they had both problems at the same time. The cure for stagnant growth (lower interest rates and higher spending) would only aggravate the inflation. And the cure for inflation (higher interest rates and lower spending) would only aggravate the stagnation. The problem seemed insoluble. Enter Supply Side Economics.

Supply Side Economics claimed that if the government cut taxes on the wealthy, it would jump-start the economy as the wealthy plowed their tax savings back into investments. New factories fitted with new technologies would produce goods at lower cost, taming inflation. And the newly hired workers would tame unemployment. It would, in effect, square the economic circle, fixing both inflation and unemployment at the same time.

Even better, more output meant government tax receipts would grow. The government could continue to spend money without having to raise taxes, it would simply materialize as a byproduct of higher levels of production! The economy would bootstrap itself in an ever-expanding, virtuous circle of tax cuts, investment, productivity, employment, and rising tax revenues. It was the proverbial something for nothing story. It seemed too good to be true.

It was.

In 1980, Ronald Reagan promised that, if elected, he would cut taxes, raise military spending AND balance the budget, all at the same time. His opponent, George H.W. Bush called it voodoo economics. But Reagan won the election and kept his promise. He cut the marginal tax rate on the highest income earners from 75% to 38%. What happened?

In 1982, the first full year for Reagan's policies, the economy shrank by 2%, the worst performance since the Great Depression. Investment, the magic transmission belt through which all other Supply Side benefits were supposed to flow, actually declined as a percent of GDP over the 1980s. Worse, Reagan's Supply Side policies created the biggest budget deficits in history. The numbers tell the story.

Jimmy Carter's last budget produced a deficit of $77 billion. At the time, it seemed huge. But Reagan's first budget swelled the deficit to $128 billion. By the next year, 1983, it had exploded to $208 billion and was creating severe problems for the economy. By 1992, at the end of the Reagan Revolution, (under Reagan's Vice President and successor, Bush, Sr.) the deficit was approaching $300 billion a year.

Annual deficits, of course, accumulate to the national debt. In 1980, the national debt amounted to less than $1 trillion. By the end of 1992, it had reached $4.35 trillion. In other words, the debt, which had taken over 200 years to reach $1 trillion, quadrupled in the 12 years of Supply Side Economics. A more complete, definitive repudiation of Supply Side's claims could not be imagined. What went wrong?

According to Supply Side theory, tax cuts should go to the wealthy for only they can afford to use the extra income to invest in the economy to increase its capacity to supply goods. But there is nothing to make sure they actually invest, especially in the U.S. economy.

The new money might simply sit in the bank, or be spent on expensive foreign imports. It might be wasted in misdirected speculation, or invested in fast growing markets like southeast Asia. Without the ability to ensure that tax cuts are, in fact, invested in new productive assets, Supply Side Economics cannot ensure any real linkage between tax cuts and the hoped-for economic boom.

Revealingly, Supply-Siders strenuously resisted calls to tie tax cuts to actual productive investments, that is, give the tax cut only after the investment had been made. This led critics to suspect the real motives behind the theory. The only thing that was certain was that the rich would become richer and revenues to the government would be lower. Beyond that, it is all just wishful thinking.

Contrast this wishful thinking with Demand Side economics. Demand Side Economics, says that if taxes are to be cut, they should go to those who earn the least amount of money. The reason is that low-income workers spend virtually all of their incomes. Money given to them goes right back into circulation, fueling a boom in consumer spending. This is essentially the policy that rescued the U.S. economy from the Great Depression. This, say the Demand Side economists, is the real foundation for an expanding economy. How has this theory held up in practice?

Bill Clinton reversed Reagan's Supply Side policies, raising taxes on the wealthy and lowering them on the working and middle class. This Demand Side formula was fiercely resisted by Republican leaders in Congress who predicted a stock market crash and another Great Depression. Indeed, every single Republican member of Congress voted against it. It took a tie-breaking vote by Al Gore in the Senate to get the bill passed. What happened?

The economy produced the longest sustained expansion in U.S. history. It created more than 22 million new jobs, the highest level of job creation ever recorded. Unemployment fell to its lowest level in over 30 years. Inflation fell to 2.5% per year compared to the 4.7% average over the prior 12 years. And overall economic growth averaged 4.0% per year compared to 2.8% average growth over the 12 years of the Reagan/Bush administrations.

It wasn't even close. The economy performed dramatically better in almost every way once Supply Side policies were replaced with Demand Side policies.

The most dramatic outcome was the reversal of the Reagan-era Supply Side deficits. Clinton's Demand Side policies not only paid down the Reagan/Bush deficits, they produced the first budgetary surpluses since 1969. By the time Clinton left office, the government was running surpluses of almost $140 billion per year. This is what he turned over to George W. Bush in January of 2001.

Bush, of course, returned to the Supply Side policies of Reagan and his father. He lowered taxes on the very rich, his base, as he calls them. His $1.6 trillion in tax cuts give 45% of the benefits to the top 1% of the population. It is classic Supply Side economics. What happened?

According to the Economic Policy Institute, "By virtually every measure, the economy has performed worse in this business cycle than was typical of past ones." GDP growth since the bottom of the 2001 recession has averaged 2.8%. But it grew at an average rate of 3.5% over the prior six recoveries dating back to World War II. Or consider jobs: 1.3% more jobs under Bush versus 8.8% more during earlier upswings.

Private sector jobs, an especially telling measure of economic health, are up only 1% since 2001 versus an average of 8.6% for past recoveries. Investment? That Holy Grail of Supply Side orthodoxy? Up 3.6% compared to the 8.2% average for the six earlier rebounds. Pick your measure: growth, jobs, income, spending, investment. The recovery based on the Bush II Supply Side tax cuts is one of the weakest ever recorded.

The one thing the Supply Side revival did excel at, not surprisingly, is debt. Bush turned a $136 billion surplus from Bill Clinton into a $158 billion deficit in his first year. When he took office, the national debt stood at $5.8 trillion. It now stands at $8.1 trillion and is projected to hit $10 trillion by 2008 when Bush's second term is over. The ten-year cumulative deficit forecast by the non-partisan Congressional Budget Office has changed from a $5.6 trillion surplus in January 2001 to a $3.4 trillion deficit in March of this year an almost inconceivable swing of $9 trillion to the worse in only six years.

After more than 17 years of experience with Supply Side economics, we now know beyond doubt that this is not an accident.

These mammoth debts are a huge boon to that rich base that Bush loves to coddle. It is they, the very rich, who loan the money to the government to fund its debts. And since more borrowing drives up interest rates, they get to do so at higher and higher rates of return. This is simple supply and demand. By increasing the demand for borrowed money in the economy as a whole, Supply Side deficits drive up the cost, not just of government borrowing, but of ALL borrowing everything from credit cards and mortgages to car loans and municipal bonds.

In other words, Supply Side economics rewards the rich both coming and going. Higher government debt leads to higher interest rates for all borrowing or in their case, lending. And then, they get to pay lower and lower taxes on their higher and higher earnings. It is a magical two-fer worth hundreds of billions of dollars a year.

This is the real reason Bill Clinton was so relentlessly hounded while in office. It wasn't that he was being serviced by an intern or that he was a particularly radical president. Indeed, Clinton himself described himself as an Eisenhower Republican. His big faux pas was that by paying down the Republican debts, he lowered interest rates, the basis of Republican earnings. In fact, real interest rates declined 40% while Clinton was in office. You can see why he simply had to go.

This is the real magic of Supply Side economics: greater-debts-leading-to-higher-returns-but-lower-taxes for the rich. It is one of the reasons the top 20% of income earners has raised its share of national income from 44% in 1980 when Supply Side policies began, to 50.1% last year. They now earn more than all of the rest of the people in the economy combined.

But it only works for the rich. If you're not rich, it is you who are paying those higher and higher interest rates and it will be you or perhaps, more precisely, your children who will be stuck with the bill for the higher government debts. Paying off those debts can only come at the expense of future economic growth for income spent paying off inflated debts is money that is not available for college tuitions, job retraining, repairing infrastructure, etc.

Rarely in matters of public policy do we have the luxury of such starkly clear, repeatedly proven, empirically founded contrasts. Demand Side economics, as we saw in the 1990s, while far from perfect, produces robust growth, budgetary surpluses, and broad based prosperity. Supply Side economics produces middling growth, soaring deficits, and broad based debt. Mountains of debt. And the mountains are growing.

If we are to salvage any kind of economic sanity and prevent the bankruptcy of the nation, the next Congress must reverse the Supply Side agenda and return the country to a responsible fiscal course.